salt tax impact new york

The rich especially the very rich. The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returns.

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

The trend among states to adopt elective pass-through entity taxes or PTETs emerged as a measure to decrease the impact of the SALT cap which was introduced under the 2017 Tax Cuts and Jobs Act.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

. The SALT deduction is only available if you itemize your deductions using Schedule A. Households making 1 million or more a year would receive half the benefit of repealing the 10000 federal cap on the state and local tax SALT deduction a study by the Urban-Brookings Tax. For your 2021 taxes which youll file in 2022 you can only itemize when your individual deductions are worth more than the 2021 standard deduction of 12550 for single filers 25100 for joint filers and 18800 for heads of household.

WASHINGTON A plan by House Democrats to reduce taxes for high earners in states like New Jersey New York and California in their 185 trillion social policy spending package. The provision was part of Gov. The SALT cap increase will have the biggest effect on high-income-tax states like New York California and New Jersey said certified financial planner Matthew Benson owner at Sonmore Financial.

After legislators realized the impact of this it was decided to simply reduce the SALT deduction to 10000. SALT limits impact ALL New Yorkers. Starting with the 2018 tax year the maximum SALT deduction available was 10000.

This consequential tax legislation available to electing pass-through entities provides a mechanism for New York State individual taxpayers to limit the impact of the. Cuomos initial budget proposal in January and it comes at a time when many Democrats are calling on Pres. The tax plan signed by President Trump in 2017 called the Tax Cuts and Jobs Act instituted a cap on the SALT deduction.

Of New Yorks. April 7 2021 Louis Vlahos Tax. 1 hour agoThe SALT deduction cap would stay at 10000.

Statewide average SALT totals. The surprise agreement between Senator Joe Manchin and other Democrats on a new health care energy and climate bill paves the way for some tax changes that. New York supports 107000 fewer additional.

Before President Donald Trump signed the Tax Cuts and Jobs. New York represents 73 of the pre-cut tax base. The climate change deal brewing in Congress which would fund the massive investment in clean energy with new taxes on corporations came with some.

The Rockefeller Institute of Government and the New York State Division of the Budget have examined the impact of the SALT cap. Job posted 4 hours ago - Alvarez Marsal Holdings LLC is hiring now for a Full-Time Manager Director Global Transaction Tax MA SALT in New York NY. Apply today at CareerBuilder.

Now they may fold for Pelosi. Rather than repealing SALT especially now when the need to spend on public health and education is clearer than ever the limit on. Scott is a New York attorney with extensive.

Almost all 96 percent of the benefits of SALT cap repeal would go to the top quintile giving an average tax cut. 22168 more than. On April 19 2021 New York Governor Andrew Cuomo signed into law legislation that creates a New York Pass-Through Entity Tax effective for tax years beginning on or after January 1 2021.

The average SALT burden is over 10000 in. The federal tax deduction for state and local tax SALT for taxpayers who itemize deductions was cut from unlimited to 10000 in 2018. This report shows that the cap which is effectively a tax increase for New Yorkers is having a sustained negative effect on employment and output in New York State.

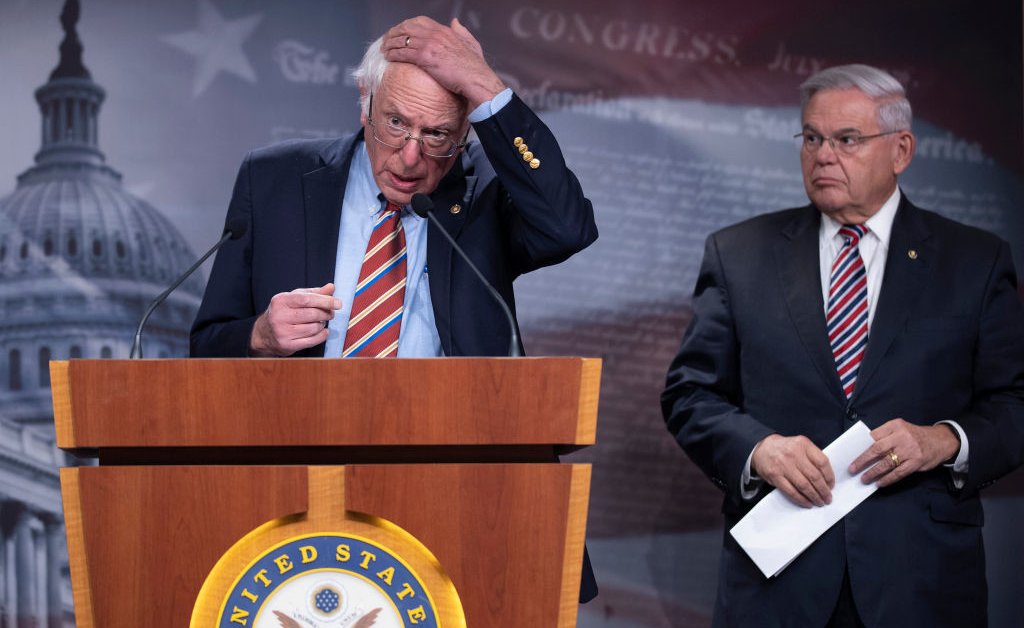

Josh Gottheimer conducts a news conference to advocate for inclusion of the state and local tax SALT deduction in the. 2 days agoHouse Democrats drew a red line on taxes. In part one of a two-part series Baker Botts William Gorrod Renn Neilson Matthew Larsen Jon Feldhammer and Ali Foyt share how a growing number of pass.

Almost 11 million taxpayers are likely to feel the pinch of a new cap on deducting state and local taxes also known as SALT deductions. On a most superficial level it might seem obvious that the TCJA provision capping state and local tax SALT deductions at 10000 would have to represent a tax increase for many middle-class residents of high-taxed states like New York where property taxes on a downstate suburban house can approach or exceed the limit. The New York state budget deal announced yesterday includes a workaround of the temporary federal limit on state and local tax deductions the SALT cap.

New York States new budget for 2022 included an elective Pass-Through Entity Tax PTE and a corresponding personal income tax credit regime which will allow NYS taxpayers to avoid some of the impact of the SALT limit. July 28 2022 301 PM MoneyWatch.

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Nyc Home Prices Plunge After Salt Deductions Capped

State And Local Tax Salt Deduction Salt Deduction Taxedu

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Two Thirds Of Millionaires Get A Tax Cut Under Build Back Better Due To Salt Relief Committee For A Responsible Federal Budget

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

Missing Salt Tax Break Complicates Path For Manchin And Schumer S Tax And Climate Change Deal Fox News

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

Why This Tax Provision Puts Democrats In A Tough Place Time

How Does The Deduction For State And Local Taxes Work Tax Policy Center

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation